by Madeleine Kando

by Madeleine Kando

When Mitt Romney was caught bemoaning the 47% of Americans who don't pay income tax, he was actually telling the truth. That is because America, contrary to popular belief, has by far the most progressive income tax system of any developed country. Europe, although it has overall higher taxes, has a less progressive tax system than America.

Progressive taxes means that the more you earn, the higher the percentage of your income goes to paying taxes. In the US, if you are single, under 65 years old and make less than $10,300, you don’t have to pay any income tax. In Sweden, if you make less than $2,400 you are exempt. Both systems are progressive, but in Sweden people start paying taxes at a much lower level of income.

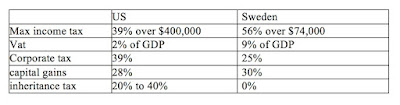

Here are the tax brackets for the US compared to Sweden. As you can see, the burden on the ‘middle class’ is higher in Sweden, which makes it less progressive. The median income is approximately the same, which gives the Swedish government much more revenue from income taxes compared to America. (I will not go into all the deductions that will change these figures. They apply both to Sweden and the United States).

On the other hand, the corporate income tax in the US is much higher than in Sweden: 39% versus 25%. (Although this does not take into account the numerous ways corporations use loopholes and offshore tax-avoidance schemes). Capital gains tax is pretty much equal and there is NO inheritance tax in Sweden.

It is obvious that, in order to pay for their generous social programs, the Scandinavian countries need a broad base of revenue (high income tax and sales tax), while still allowing corporations to thrive and not be overtaxed. (low corporate, capital gains and inheritance tax).

In Holland, the tax system is similar to the one in Sweden. I asked some of my Dutch friends if they didn't mind paying what Americans would consider a valid reason to riot in the streets. This is what they said: 'we don't mind at all. We have all we need. If paying taxes would make our lives worse, we would be against it, but it's making our lives better. It's a good system.'

Can we say the same here? What do we really get in return for our taxes? Certainly not what you get in Scandinavia: practically free medical care, free education, free child-care, roads that are smooth as a baby's bottom, a transportation system that takes you from Amsterdam to Paris in less than 3 hours.

The fact that a smaller section of the population pays taxes keeps the Government in the red. The fact that an even smaller segment pays for the bulk of it, (the top 20% of earners pay 84% of income tax) has given taxes a bad name and is looked upon as charity, money flowing from the rich to the poor. Taxes are supposed to make our lives better, after all, we ARE the government, although corruption, special interests and corporate money have obscured that simple fact.

So, why cannot we be more like the Nordic countries? Isn't that what Bernie Sanders keeps telling us? That we should be like Denmark? The total tax revenue as a percentage of GDP in Denmark is 49%. In the US it is 29%. The only way to get more revenue, is by raising taxes on low to middle income Americans to broaden the tax base, but that will never happen, unless we feel that our taxes are money well spent.

Knowing that 19% of our revenue is spent on the military, versus the 4% that Sweden spends doesn’t help. Especially because it mostly benefits other countries. We are the world’s designated policeman and this allows countries like Sweden to take it easy and adopt what the authors of ‘Asymmetric Growth and Institutions in an Interdependent World’ call a ‘cuddly capitalism’.

The Northern countries can have their cake and eat it too. The Nordic Model is touted as the answer to inequality and poverty, only because it can free-ride on the ‘winner take all’ American capitalism, which creates inequality but, the authors argue, also more innovation and technological leadership. The world equilibrium is asymmetric, and countries with ‘cuddly’ reward structures, though poorer, have higher welfare. Besides, if we became like Denmark, who would protect us? Who would walk the beat?

Things are extreme in this country, including our tax system. It is meant to protect the poor, but it has the opposite effect. It has caused us to be suspicious of what the government does with our money.

Be that as it may, we could learn from the Nordic countries without loosing our technological and innovation edge. When revenue is well spent and redistributed in a smart and productive way, everybody wins. That is what my Dutch friends are telling me: they don't resent paying taxes because they know it will eventually benefit them, not anyone else.

leave comment here

Youtube

Contact Form

Popular Posts

-

By Madeleine Kando Flying is like signing away your rights as a human being. Not only is your life put on hold, but you never know which sid...

-

By Tom Kando Only one thing aggravates me more than the mistakes of the electorate - as exemplified by the Democratic loss in Massachusett...

-

by Madeleine Kando We left Boston early Sunday morning, the day before the 2024 Solar Eclipse. We have friends who live close to the Canadia...

-

Tom Kando Some societies are more successful than others. Today, there are successful societies such as Australia, Canada and Scandinavia,...

Tom's Publications and Essays

Madeleine's Publications and Essays

interesting links

Publish Your Article!

A valid author name is required. We will create live links to url's that you specify in your post. Please be patient, and allow us some time to read and approve your article.We reserve the right to refuse any articles that are not deemed appropriate for this blog.